Services

Comprehensive Review

I will review your complete financial situation including income, expenses, assets, liabilities, investments, insurance policies, tax situation and budget.

Financial Plans

I will help you determine your short, medium and long-term financial goals and develop a plan to help you achieve these objectives.

Investments

I will do a comparison of your current investments to other available options to see if any changes could be beneficial.

Account Types Offered

TFSA, RRSP, LIRA, RESP, RDSP, RIF, Cash, Group Plans

Investment Types Offered

Mutual Funds, Segregated Funds, GICs, Exempt Market Products, Flow-Through Shares

Insurance

I will review your current life and personal insurance needs to ensure you have the right amount of coverage.

Insurance Types Offered

Term Life, Whole Life, Disability, Critical Illness, Travel

Health Coverage

I will help you better understand your existing health benefits. I can offer you a personalized plan for you, your family and your employees.

Banking Needs

I will review your current banking practices to ensure their efficiency. I have referral agreements with banks that offer chequing and savings accounts, mortgages, lines of credit and credit cards.

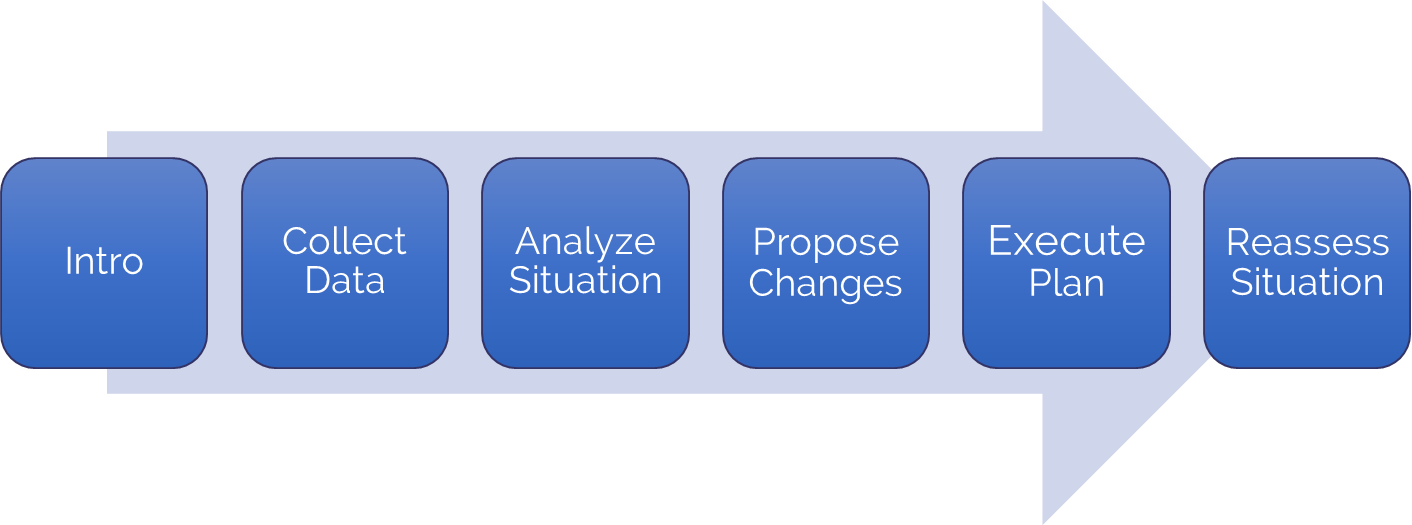

Six-Step Process

1. Introduction

We speak on the phone or over email to see if we are a good fit. We then set up an appointment at a time and location that is convenient for you and your spouse.

2. Information Gathering

To provide you with a quality financial plan, I will obtain accurate information regarding your income, expenses, assets, liabilities, current investments, current insurance policies and any other information that may impact your financial future. This is done using a four-page questionnaire to ensure that nothing is missed.

3. Current Situation Analysis

I will complete a full review of the information gathered and create a report. The analysis includes a full review of current investments compared to other options, a comparison of current insurance coverage to actual insurance needs and a full written retirement forecast if desired.

4. Recommendations

We meet again and I provide you with a written report that shows you the benefits and risks of each recommendation so you can make an informed decision on what you want to implement.

5. Implementation of Plan

You decide what pieces, if any, of the recommendations you want to implement. I will then help you execute these ideas. This part of the process can take anywhere from minutes to months and multiple meetings.

6. Continual Reassessment

Financial planning is an ongoing and evolving relationship in which we continue to work together as your lives and financial situations evolve. I conduct a full review of all my clients' accounts every 3 months. I strive to see all of my clients at least once per year or more if required or requested. I work hard to respond to every message within 72 hours.